Electronic invoicing becomes mandatory in Germany

While electronic invoicing (e-invoicing) has already been mandatory for some time in co-operation with public clients (B2G), this obligation is now to be extended to the area of business-to-business (B2B) transactions. Among other things, this will mean that companies will have to receive, process, send and archive invoices from € 250 electronically.

As part of the Growth Opportunities Act, the German government has introduced a corresponding bill. This was approved by the Bundestag, but the Bundesrat refused to give its consent. The mediation committee has now proposed amendments, which the Bundestag has again approved. In order for the law to enter into force, the Bundesrat must also approve it at its next meeting on 22 March 2024. Although it is currently unclear when the e-invoice will actually come into force, it is certain that it will.

What requirements must an electronic invoice fulfil in future?

EU Directive 2014/55/EU stipulates that the invoice content in e-invoices must be available in a structured and machine-readable data set. This ensures that the invoice is processed digitally and without media discontinuity from its creation to payment. The data format must comply with the European standard EN16931.

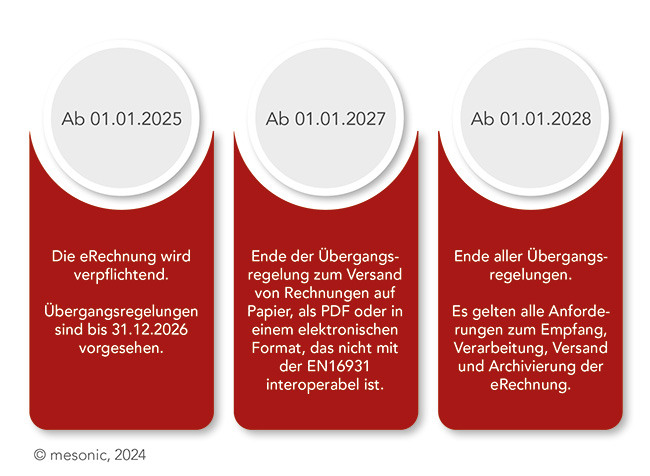

Planned timeline

The Growth Opportunities Act has not yet been passed. For this reason, the timeline planned in the draft bill, which we have reproduced here, is currently only an indication and is subject to change:

The eInvoice in the WinLine

With the WinLine eBilling DE module, you can already create and send electronic invoices in the EN16931-compliant data formats ‘ZUGFeRD’ and ‘XRechnung’ in the WinLine ERP system. We are also preparing to enable you to receive and process e-invoices in compliant formats in WinLine in the future.

Our document management system WinLine ARCHIVE will support you in archiving your invoices, which is also mandatory.

This means that you are still on the safe side with WinLine when eInvoicing is launched in Germany!

Background information

The mandatory introduction of electronic invoicing is a central component of the EU Commission's so-called ViDA initiative (VAT in the Digital Age). One of its aims is to reform current VAT law and introduce an EU-wide electronic reporting system to replace the existing recapitulative statements (SRs) and combat VAT fraud in the EU more effectively.

With the current draft bill, the German government is also addressing this issue for domestic B2B transactions.