Obligation to issue electronic invoices in Germany from 1 January 2025

With the adoption of the Growth Opportunities Act, the German Federal Ministry of Finance (BMF) decided to introduce structured electronic invoicing (e-invoicing). In its letter dated 15 October 2024, the BMF sets out its requirements and transitional provisions.

From 1 January 2025, electronic invoices will be mandatory for transactions between German companies!

What does this mean for companies in Germany?

From 1 January 2025, domestic companies in Germany must be able to receive invoices electronically (no PDF!). The new law also provides for the sending of electronic invoices, subject to transitional provisions. This only applies to services between companies (B2B).

What does this mean for companies in Austria?

The statutory e-invoicing obligation in Germany from 1 January 2025 will also increase the pressure on Austrian companies to create and receive structured electronic invoices. Especially as the EU-ViDA Directive (VAT in the Digital Age) - planned from 2028 - provides for digital reporting and structured, electronic invoicing within the EU.

We answer the most important questions about electronic invoicing (e-invoicing)

What is an e-bill?

In future, e-invoices will be issued in a structured electronic XML format, based on the EU standard EN 16931. This uniform standard enables the electronic receipt, transmission and processing of invoices.

Invoices in PDF format no longer fall under the definition of an electronic invoice, but are categorised as ‘other invoices’.

What exceptions have been decided?

So-called ‘low-value invoices’, whose total amount does not exceed EUR 250, still do not have to be issued and transmitted electronically - in deviation from the general obligation. For details, we recommend contacting your tax advisor.

What about digital reporting obligations for intra-EU transactions?

The European Commission has launched the ViDA (VAT in the Digital Age) project for this purpose. This proposed a series of measures to modernise the current VAT system in the European Union in order to combat tax fraud.

The initiatives include the introduction of a new tax reporting system through electronic invoicing between businesses. This was originally planned for 2028. However, the member states have not yet been able to reach an agreement on the start date. Therefore, no binding statement can be made about the actual date at this time.

How is the electronic invoice implemented in the WinLine?

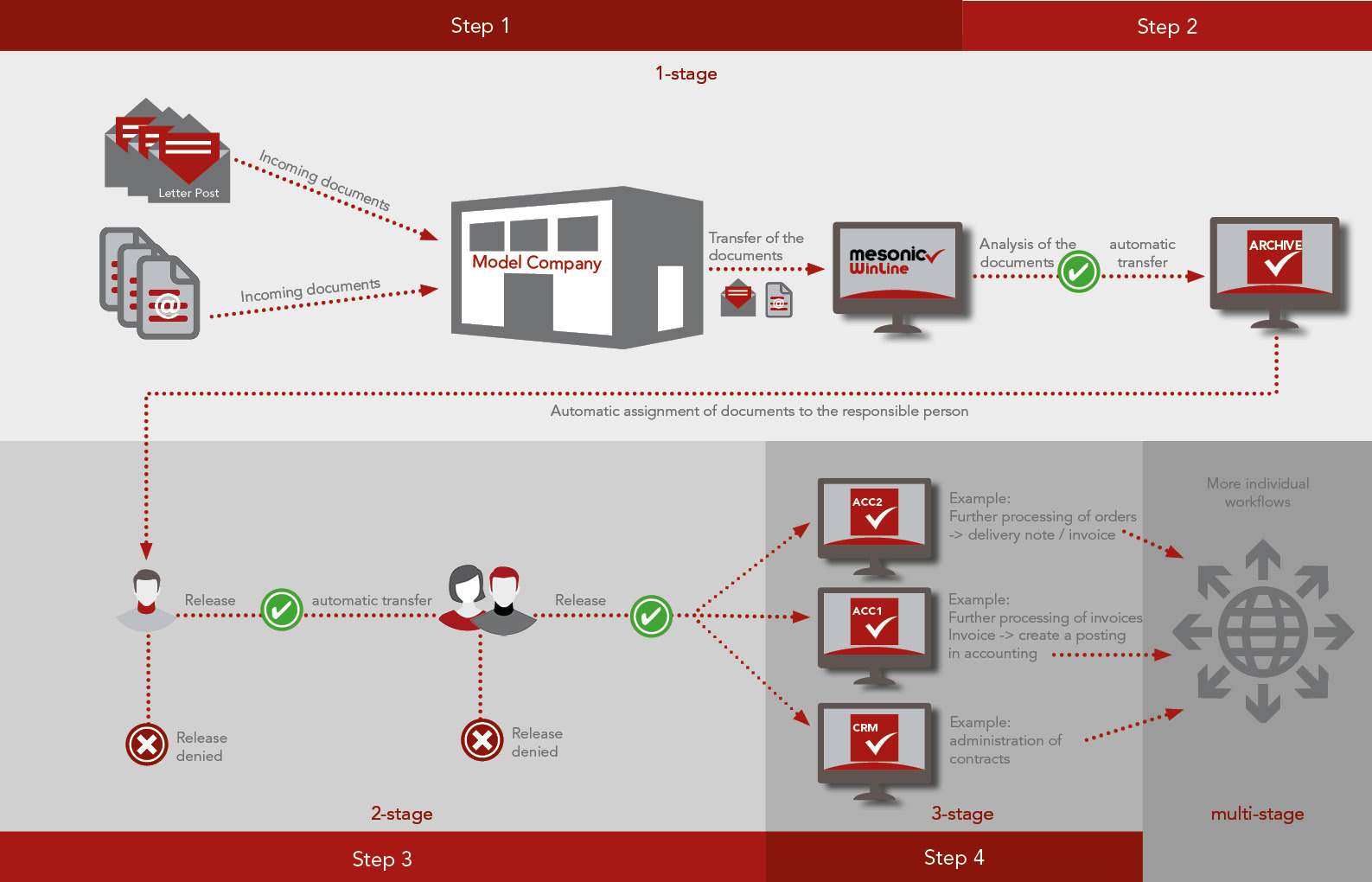

When introducing electronic invoicing, a distinction must be made between incoming and outgoing invoices. WinLine already offers proven solutions that fulfil the necessary requirements for the implementation of e-invoicing! The good news is that the requirements can be implemented in existing WinLine modules!

The central element will be the WinLine ARCHIVE which, in combination with the WinLine CRM, controls the distribution of documents for the areas of sending (WinLine eBILLING) and receiving (WinLine VOUCHER PRO). The WinLine ARCHIVE enables you to archive documents in an audit-proof manner and thus also fulfils the requirements of immutability for electronic invoices.

With WinLine you are prepared for the electronic invoice!

Further advantages of WinLine BELEG PRO:

To process your incoming invoices faster, you can automate the entire process with this module. You define the individual digital work steps individually for your company. The invoice document can either be forwarded for approval via an automatic workflow or converted into a booking record.

How are e-invoices received and processed in the WinLine?

E-invoices are received and processed in WinLine ACC1 and WinLine ACC2 with WinLine VOUCHER PRO.

- WinLine VOUCHER PRO will receive and process structured e-invoices in XML format.

- With the WinLine ARCHIVE you can archive in accordance with the law, so that no external document management system is required. The WinLine ARCHIVE is part of the WinLine CRM or the WinLine digitisation package.

How is an e-invoice sent from the WinLine?

In WinLine ACC2, electronic invoices are sent with WinLine eBILLING.

This also includes the ‘XRechnung’ and ‘ZUGFeRD (Factur-X)’ standards commonly used in Germany. Areas of application for this include transactions with public authorities or organisations. The European standard EN 16931 used therein is forward-looking at B2B level according to the German federal government.

Where can I find out more about the implementation of e-billing in WinLine?

You have several options for ensuring receipt, processing and dispatch with the WinLine. Talk to your mesonic partner and decide together which option is right for your company.

Examples: Receiving and sending e-invoices

(Videos in German)